How to Nail Your Airbnb Bookkeeping from the Start

It’s about finding the software that fits your business model, meets your specific needs, and helps you achieve your business goals. It’s about finding a tool that simplifies your accounting processes, gives you insights into your financial health, and, ultimately, helps you grow your Airbnb business. Having familiarized yourself with the best accounting software tools for Airbnb hosts, you might be pondering – which one suits me best? While all the solutions reviewed in this post are top-notch, they each have their strengths and cater to different needs. Xero is unbeatable when it comes to retained earnings enabling data-driven decisions for your Airbnb business. With its advanced business analytics tools, Xero not only helps you manage your finances but also generate insights that can help optimize your business performance.

- As an expert Airbnb host, it’s important to stay on top of your accounting and bookkeeping tasks.

- When it comes to accounting software, most Airbnb hosts may initially think of generic solutions like QuickBooks or Xero.

- There are other exceptions, as well as unexpected tax implications that can arise.

- It’s not just about picking the software with the most features or the lowest price.

Wave: Best Budget-Friendly Option for Airbnb Hosts

Despite this, Instabooks remains a top choice for hosts looking for AI-driven accounting software that’s as smart as they are. Its visually appealing design, intuitive navigation, and user-friendly platform make it a favorite among Airbnb hosts, especially those who are not tech-savvy or just starting out. With FreshBooks, managing your Airbnb accounting becomes a breeze, not a chore. For instance, you can airbnb bookkeeping choose which income platforms and expense categories you wish to track.

Open a Bank Account Specifically for the Business

From tracking income and expenses to managing tax liabilities, Wave offers a comprehensive suite of features that would usually come with a hefty price tag. Airbnb accounting software also integrates seamlessly with different property management tools and systems. This allows you to manage all aspects of your property business from a single platform. You can track reservation data, manage cleaning fees, and even handle online payments, all without leaving your accounting software platform. While hiring a property manager for your Airbnb business may seem like an added expense, it can actually save you time and money in the long run.

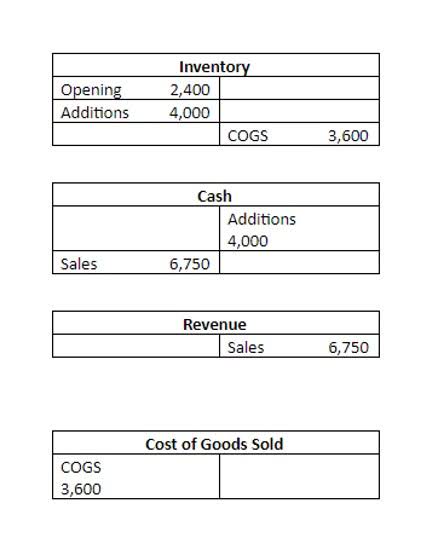

Key Metrics for Airbnb Spreadsheet

- They can also provide valuable insights and advice to help you maximize your earnings and streamline your operations.

- With professional accounting and bookkeeping services, Airbnb hosts can ensure their finances are in order and maximize their earnings without the hassle of managing it themselves.

- In addition, you may also be required to collect and remit Goods and Services Tax/Harmonized Sales Tax (GST/HST) if your annual revenues exceed the threshold set by the Canada Revenue Agency (CRA).

- If you are using Quickbooks, you can use class accounting, or tracking category if you are using Xero.

Tracking your financial performance is essential for understanding the profitability of your Airbnb business. By regularly analyzing your financial data, you can make informed decisions to optimize your operations and increase your earnings. Some provinces and municipalities may levy an occupancy tax on Airbnb rentals. This tax is typically a percentage of the rental price and is collected by the platform on behalf of the host. Ensure that you are aware of any local regulations regarding occupancy tax and include it in your pricing calculations.

Invoice Details and Status Reports

If you are using Quickbooks, you can use class accounting, or tracking category if you are using Xero. If you haven’t migrated from excel, consider using a cloud-based accounting system to keep track of your properties (especially if you have more than one). I highly recommend Baselane for landlords needing a free solution for managing multiple units.

While the core accounting features are free, certain services like bank transfer and credit card payments do incur a fee. And if you want to use the Payroll module, it comes with a monthly subscription fee. Nonetheless, for hosts just starting an Airbnb business or those operating on a tight budget, Wave offers excellent value for money. As an Airbnb host in Canada, you are required to report your rental income on your tax return. You may also be eligible for certain deductions and credits related to your hosting expenses.

What is Airbnb accounting?

Firstly, these products are super easy to run and I have simple notes to guide you through. You example, if you host 6 Airbnb properties, the 1 to 10 properties spreadsheet Bookstime would suit your needs. I encourage you to check out the BnbDuck Multiple Property Spreadsheet below. These are all the costs of setting up your Airbnb, prior to the listing going live. I like to keep these on an individual tab, keeping them separate from ongoing costs. Make sure you are recording the total amounts of all of your assets and major upgrades.